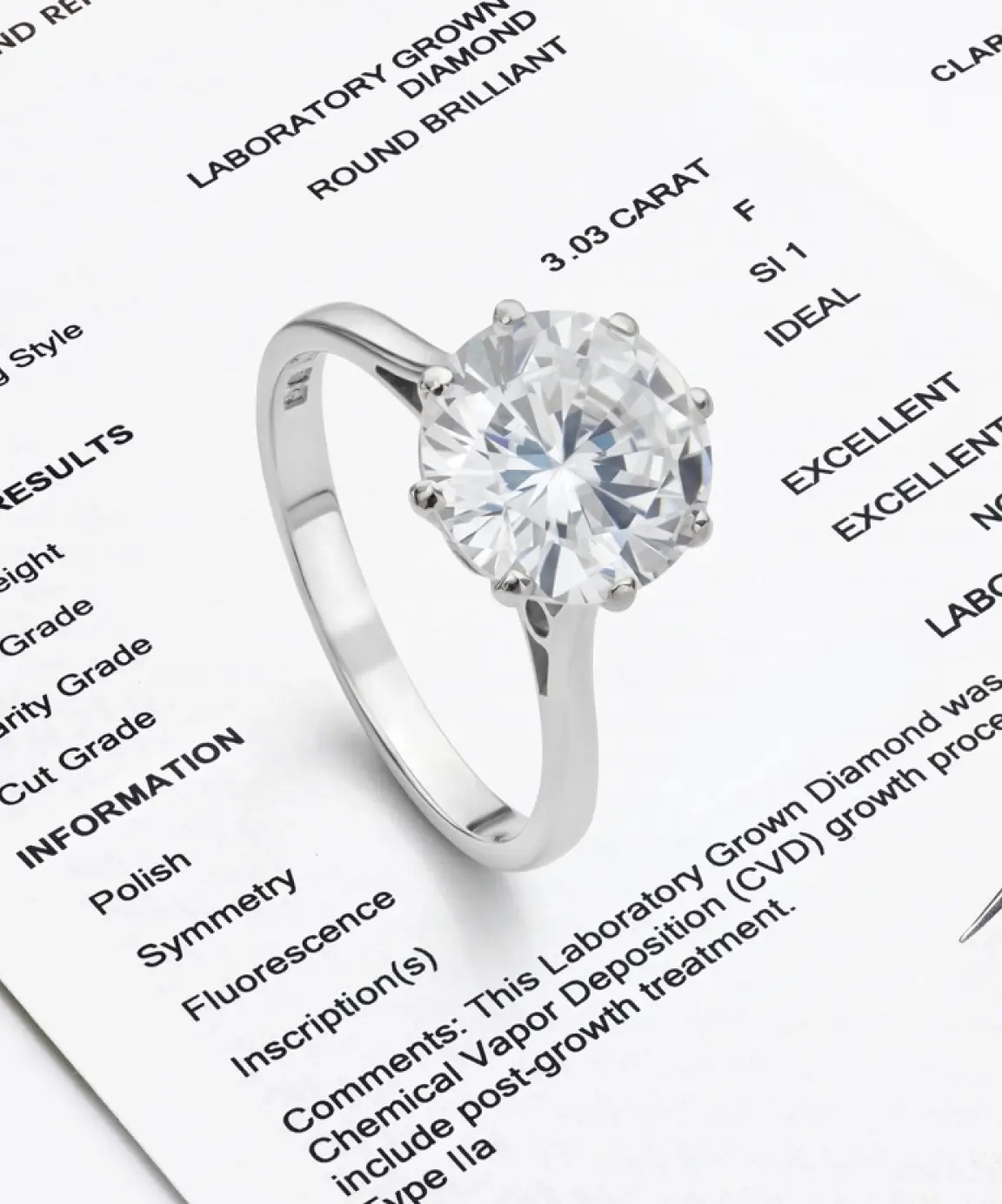

As the famous saying goes, "diamonds are forever"; but unfortunately, things don't always go as planned. When you get engaged, your engagement ring often becomes one of the most treasured assets in your life. Keeping all unpredictable circumstances in mind, losing or damaging your engagement ring can be a heartbreaking experience, not just emotionally but also financially. That's why it's crucial to protect your engagement ring through insurance. By getting an engagement ring insurance, you can guard your most cherished piece of jewelry, ensuring that your precious ring is protected from loss, theft, or damage. Let's explore the importance of engagement ring insurance and how it can provide you with peace of mind for years to come.

TABLE OF CONTENT

Why Should you Consider Insuring Your Engagement Ring?

An engagement ring is not only an intrinsic symbol of love, but also a significant investment of one’s savings. Losing an engagement ring can be a devastating experience, but having an insurance cover gives you solace knowing that you will be financially compensated. With insurance, you don't have to worry about the cost of repair or replacement of a ring that's lost or damaged. This can be especially important if your ring has sentimental value or is a family heirloom.

EXPLORE ENGAGEMENT RING SETTINGS

Many insurance providers offer policies that cover the full value of your engagement ring and some even offer coverage for the ring while it is being worn. You can choose to add engagement ring insurance as an extension to your existing homeowner's or renter's insurance policy or take out a separate policy solely for your engagement ring. If you want to safeguard your engagement ring and have a worry-free experience while adorning it, obtaining insurance coverage is essential. It's just a small expense that can potentially save you a significant amount of money and emotional distress down the road, making it a wise investment in the long term.

What does Engagement Ring Insurance Typically Cover?

Engagement ring insurance is a type of insurance policy that specifically covers the financial loss or damage of an engagement ring. Every insurance provider offers different coverage options but typically, engagement ring insurance covers the following:

Loss or Theft

Engagement ring insurance policies usually cover the loss or theft of your ring. If your ring is lost or stolen, your insurance provider will provide the compensation for its replacement.

Damage

Engagement rings can be damaged due to various reasons such as scratches, chips, or cracks. If your ring is damaged, your insurance provider will cover the cost of repair or replacement.

Accidental Loss

Sometimes, engagement rings can accidentally fall off the wearer's finger and get lost. In such cases too, engagement ring insurance typically provides the coverage.

Natural Disasters

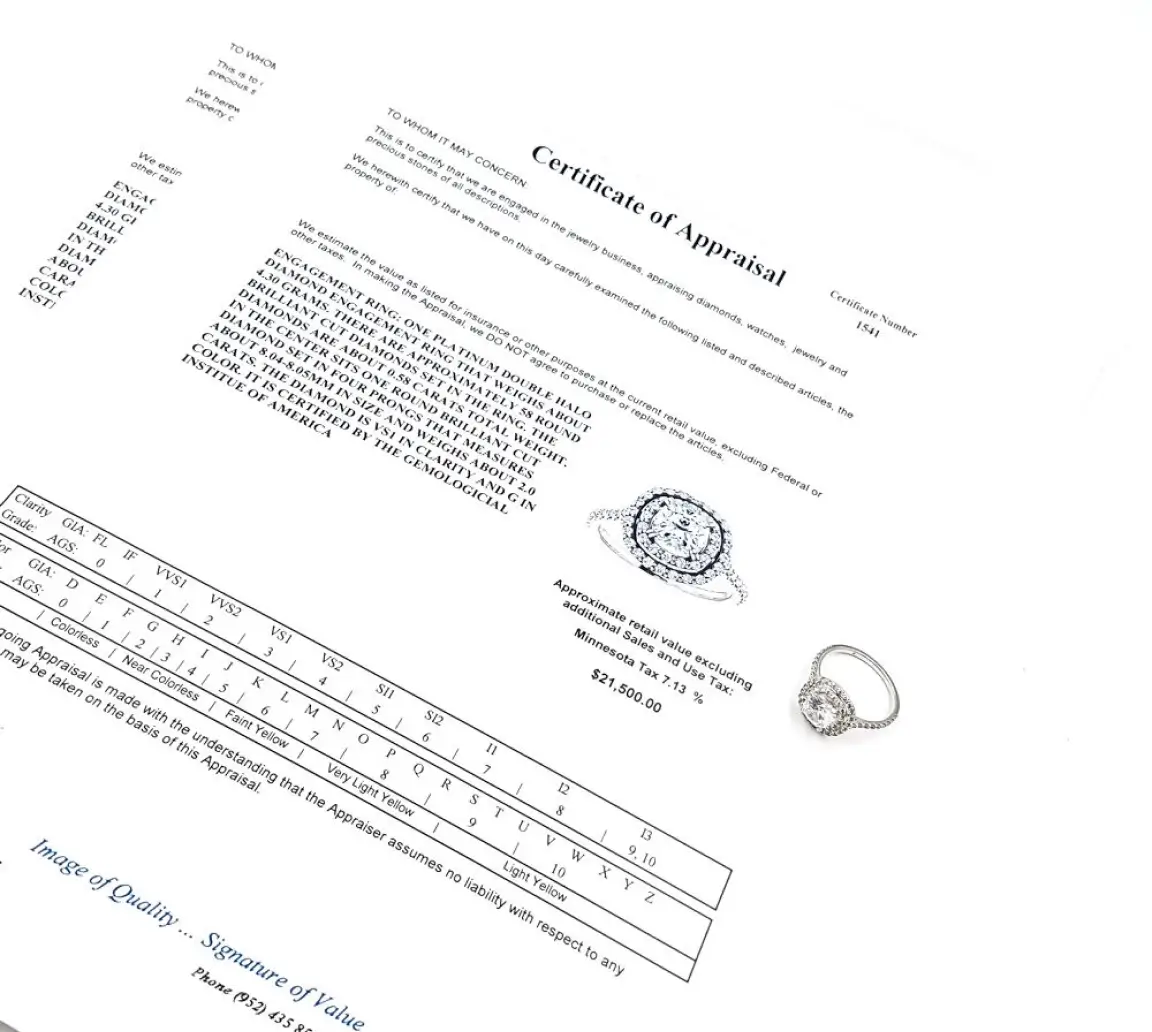

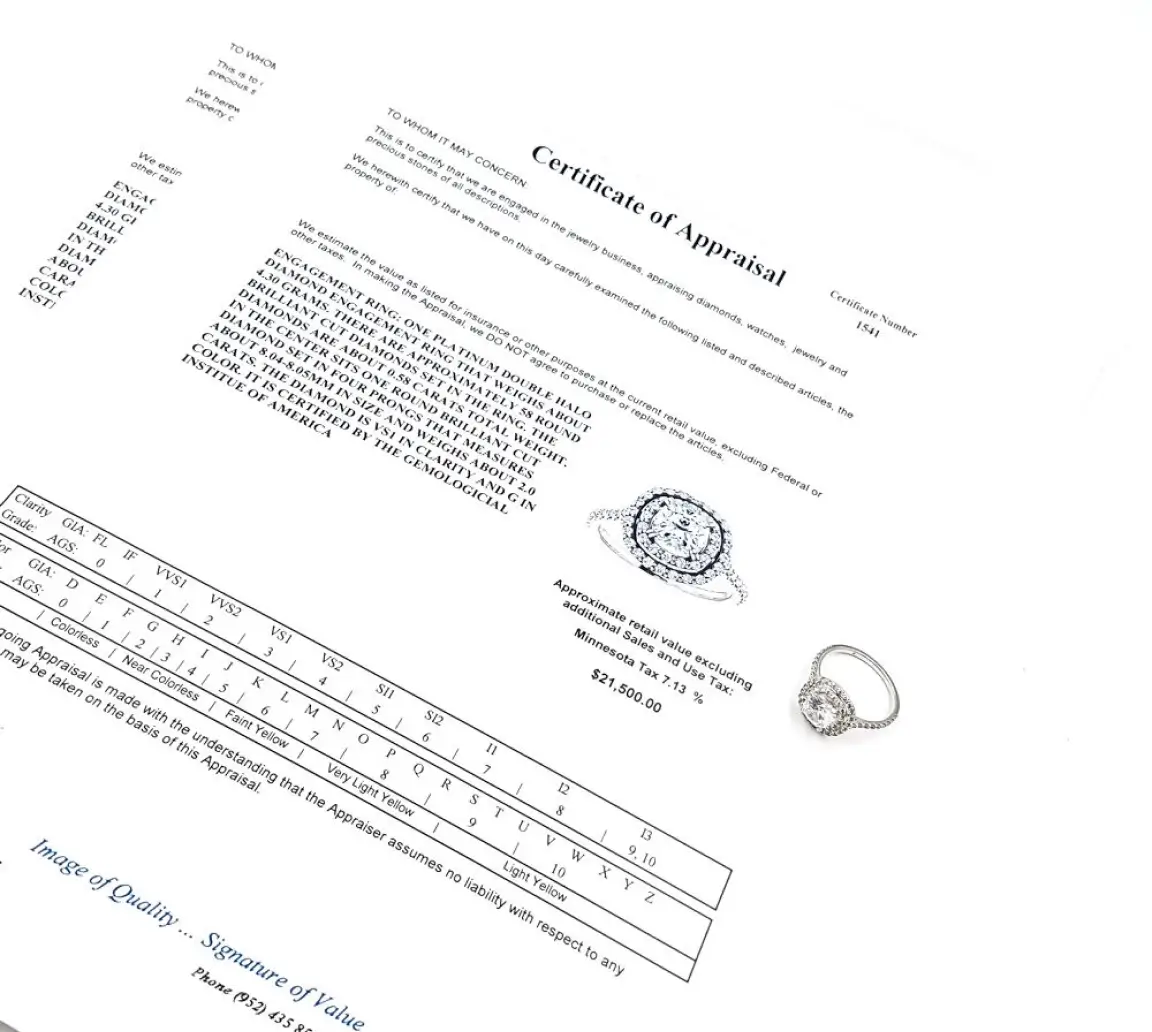

In odd cases, natural disasters such as earthquakes, floods, or fires can also be the reason for damage or destruction of your engagement ring. Insurance providers often cover damage caused by such disasters. It's important to note that engagement ring insurance typically doesn't cover normal wear and tear, or any damage caused by negligence or intentional harm. Additionally, most insurance providers require a proof of ownership, such as a receipt or an appraisal to file a claim.

When it comes to insurance coverage for engagement rings, it's important to be aware of what's included and what's not. As mentioned, such coverage usually includes protection against theft, loss, accidental damage, and even natural disasters. Nevertheless, it's crucial to thoroughly examine the policy terms and conditions to have a clear understanding of the extent of coverage and any limitations or exemptions that may apply.

How much does Engagement Ring Insurance Cost?

The cost of engagement ring insurance varies depending on factors such as the value of the ring, the location, and the insurance provider. On average, you can expect to pay around 1-2% of the ring's appraised value per year for coverage. For example, if your engagement ring is worth $10,000, you may pay between $100-$200 annually for its insurance coverage. Several factors can affect the cost of your engagement ring insurance, such as the type of policy you select, the amount of your deductible, and additional coverage (if any). A standard policy typically covers loss, theft, and damage while additional coverage options may include worldwide protection, full replacement cost, and more.

It's important to note that while the cost of engagement ring insurance may seem like an additional expense, it's a small price to pay for avoiding future regrets. The cost of replacing a lost or damaged engagement ring can be significant, and insurance coverage can save you from financial stress in case of an unfortunate event. When shopping for engagement ring insurance, it's essential to compare multiple policies from various insurance providers, read the policy details carefully, and understand the coverage limits and exclusions. As you do this, you can be sure that you will receive better coverage at an affordable price to safeguard your investment.

How to Choose the Right Insurance Provider for Your Engagement Ring?

It is very essential to pick the right insurance provider for your engagement ring as it helps you receive the best coverage for your investment. Given below are a few tips that would help you pick the right insurance provider for your engagement ring.

Do Your Research

Before looking for the best insurance policy, ensure that you carry out thorough research and compare various providers. Look for providers that specialize in jewelry insurance and have a good reputation for customer service and claims handling.

Check the Coverage Options

Make sure that the insurance policy covers everything you need including loss, theft, damage, and accidental loss. Also, consider additional coverage options such as worldwide protection, full replacement cost, and more.

Consider the Deductible

Check the deducted amount and make sure that it is affordable for you. A bigger deductible amount will decrease the value of the insurance policy. But this also means that you may end up spending more from your pocket if you ever make a claim.

Check the Claims Process

Look for an insurance provider that has a straightforward claims process and offers fast and efficient claims handling.

Read the Policy Details Carefully

Before choosing an insurance provider, take the time to carefully read and understand the policy details, evaluate the coverage limits, exclusions, and any kind of additional fees.

Ask for Recommendations

Ask for recommendations from family and friends who have insured their jewelry or consult with a jeweler to see if they can recommend a reputable insurance provider. Securing insurance coverage for your engagement ring is a decision that should be approached with careful thought and research. To make an informed choice, take the time to compare policies, assess coverage options, evaluate deductibles, scrutinize the claims process, and read the policy terms thoroughly. Seeking recommendations from trusted sources can also be beneficial in selecting a reputable insurance provider that will safeguard your cherished investment.

At Friendly Diamonds, we understand what your diamond jewelry means to you and we strive to go above & beyond to educate you about all things in the world of lab diamonds. Feel free to book our virtual appointment if you would like to know anything about your lab diamond jewelry.